Life insurance is a fundamental component of financial planning, providing financial protection and security for your loved ones in the event of your death. Understanding life insurance planning and the various options available is essential for individuals and families to make informed decisions about their coverage. Here’s a comprehensive overview of life insurance planning and options:

- Assess Your Needs:

- The first step in life insurance planning is to assess your financial obligations, including mortgage payments, debts, living expenses, education costs for children, and future financial goals.

- Consider your income, assets, liabilities, and the financial needs of your dependents to determine the amount of coverage needed to provide for your family in your absence.

- Types of Life Insurance:

- Term Life Insurance: Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. It offers a death benefit to beneficiaries if the insured passes away during the term of the policy.

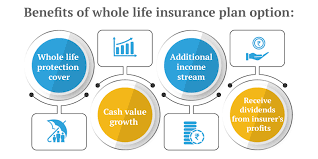

- Whole Life Insurance: Whole life insurance provides coverage for the entire life of the insured, as long as premiums are paid. It also includes a cash value component that grows over time and can be accessed through loans or withdrawals.

- Universal Life Insurance: Universal life insurance offers flexibility in premium payments and death benefits. It combines a death benefit with a cash value component that earns interest at a variable or fixed rate.

- Variable Life Insurance: Variable life insurance allows policyholders to allocate premiums into investment options, such as stocks, bonds, or mutual funds. The cash value and death benefit of the policy may fluctuate based on the performance of the underlying investments.

- Considerations in Choosing a Policy:

- Coverage Amount: Determine the appropriate coverage amount based on your financial needs, taking into account outstanding debts, future expenses, and income replacement needs.

- Premiums: Evaluate the affordability of premiums based on your budget and financial circumstances. Term life insurance typically has lower premiums compared to permanent life insurance.

- Policy Duration: Consider the length of coverage needed to meet your financial obligations and goals. Term life insurance is suitable for temporary needs, while permanent life insurance provides lifelong coverage.

- Cash Value: Determine whether you prefer a policy with a cash value component for potential savings and investment opportunities, or if you prioritize lower premiums and pure death benefit protection.

- Riders and Add-Ons: Explore optional riders and add-ons, such as accelerated death benefits, waiver of premium, or accidental death benefit riders, to enhance your coverage and customize your policy.

- Review and Update Your Coverage:

- Regularly review your life insurance coverage to ensure it aligns with your changing financial situation, family dynamics, and goals.

- Consider updating your coverage after major life events, such as marriage, the birth of a child, purchasing a home, or changes in income or employment status.

- Review beneficiary designations and ensure they reflect your current wishes and intentions.

- Work with a Financial Advisor:

- Consult with a financial advisor or insurance professional to assess your insurance needs, explore available options, and select the most suitable policy for your circumstances.

- A financial advisor can provide personalized guidance, conduct a thorough analysis of your financial situation, and recommend strategies to optimize your life insurance coverage within your overall financial plan.

Life insurance planning is a critical aspect of financial security and protection for your loved ones. By understanding your insurance needs, exploring the various types of life insurance policies, and working with a trusted advisor, you can make informed decisions to ensure your family’s financial well-being and peace of mind.