Insurance policies are notorious for their dense, jargon-filled fine print, often leaving policyholders feeling confused and overwhelmed. However, understanding the intricacies of your insurance coverage is crucial to ensuring you receive the protection you need when the unexpected occurs. In this guide, we’ll decode the fine print of insurance policies, empowering you to make informed decisions and navigate the complexities of insurance contracts with confidence.

1. **Know Your Coverage Limits:** One of the most important aspects of any insurance policy is its coverage limits. This refers to the maximum amount the insurer will pay out for a covered claim. It’s essential to understand these limits to avoid any surprises when filing a claim. Review your policy carefully to determine the coverage limits for different types of claims, such as property damage, liability, or medical expenses.

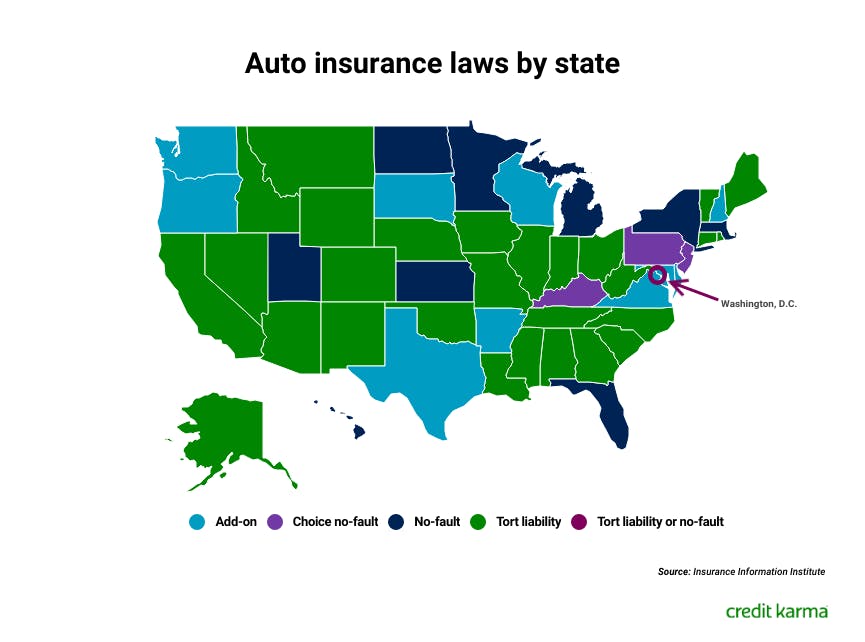

2. **Understand Exclusions and Limitations:** Insurance policies often contain exclusions and limitations, specifying what is not covered under the policy. These can range from specific perils or events to certain types of property or circumstances. Take the time to identify these exclusions and limitations in your policy to avoid misunderstandings or unexpected gaps in coverage. If necessary, consider purchasing additional coverage or endorsements to address any areas of concern.

3. **Deductibles and Co-payments:** Deductibles and co-payments are the out-of-pocket expenses you must pay before your insurance coverage kicks in. Understand the amount of your deductible and any applicable co-payments for different types of claims. Consider how these costs will impact your finances and factor them into your overall budgeting and financial planning.

4. **Review Policy Renewal Terms:** Insurance policies are typically renewed annually or periodically, with premiums subject to change based on various factors. Review the renewal terms of your policy, including any changes in premiums, coverage limits, or terms and conditions. Take note of any deadlines or requirements for renewing your policy to avoid gaps in coverage or policy lapses.

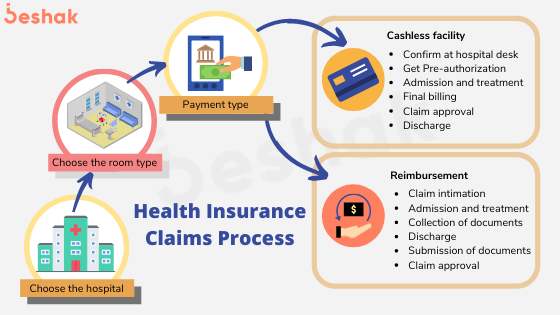

5. **Claims Process and Procedures:** Familiarize yourself with the claims process and procedures outlined in your insurance policy. Understand the steps you need to take to file a claim, including documentation requirements, deadlines, and contact information for the insurer or claims adjuster. Promptly report any incidents or losses to your insurance provider to initiate the claims process efficiently.

6. **Seek Clarification:** If you encounter any terms or provisions in your insurance policy that are unclear or confusing, don’t hesitate to seek clarification from your insurance agent or provider. Ask questions and request explanations until you fully understand the terms and conditions of your coverage. It’s better to address any concerns upfront than to discover gaps or misunderstandings when it’s time to file a claim.

7. **Regular Policy Reviews:** Finally, make it a habit to review your insurance policy regularly, especially when significant life changes occur, such as marriage, divorce, the birth of a child, or purchasing a new home or vehicle. Update your coverage as needed to ensure it remains adequate and relevant to your current circumstances.

In conclusion, decoding the fine print of insurance policies is essential for understanding your coverage and maximizing the benefits of your insurance protection. By following these tips and taking the time to review and understand your insurance policy thoroughly, you can feel confident knowing you’re prepared for whatever life may throw your way.