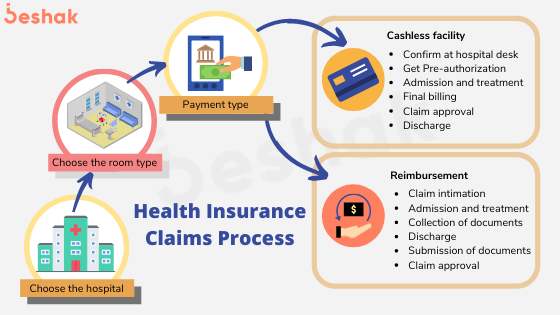

The insurance claims process is a series of steps that policyholders follow to request compensation from their insurance provider for covered losses or damages. Whether it’s auto insurance, homeowners insurance, health insurance, or any other type of insurance, the claims process typically involves the following stages:

- Notification: The first step in the claims process is to notify your insurance company about the incident or loss that you’re seeking coverage for. This may involve contacting your insurance agent, broker, or the insurance company’s claims department directly. Provide all relevant details about the incident, including the date, time, location, and nature of the loss.

- Documentation: Once the insurance company is notified of the claim, they will request documentation to support your claim. This may include photographs, police reports, medical records, repair estimates, receipts, or any other relevant documentation related to the incident. Be sure to gather and submit all required documents promptly to expedite the claims process.

- Claim Evaluation: After receiving the necessary documentation, the insurance company will assess the validity of the claim and determine coverage eligibility based on the terms and conditions of your insurance policy. They may conduct an investigation, review the evidence provided, and consult with experts if necessary to evaluate the extent of the loss and the amount of compensation owed.

- Coverage Determination: Once the claim is evaluated, the insurance company will determine whether the loss is covered under your insurance policy and, if so, the extent of coverage provided. They will also assess any deductibles, limits, or exclusions that may apply to the claim and calculate the amount of compensation owed to you.

- Claims Settlement: If the claim is approved, the insurance company will issue a settlement payment to the policyholder or directly to the service provider, such as an auto repair shop or medical facility. The settlement amount will be based on the terms of your insurance policy and may cover repair costs, medical expenses, property damage, or other covered losses.

- Appeals Process (if applicable): If you disagree with the insurance company’s decision regarding your claim, you may have the option to appeal the decision. This typically involves providing additional documentation or evidence to support your claim and requesting a review of the decision by a higher authority within the insurance company.

- Closure: Once the claim is settled and any disputes are resolved, the claims process is considered closed. Be sure to review the settlement documentation carefully and follow up with the insurance company if you have any questions or concerns about the resolution of your claim.

It’s important to note that the claims process may vary depending on the type of insurance and the specific circumstances of the claim. Additionally, policyholders are expected to cooperate with the insurance company throughout the claims process by providing accurate information, cooperating with the investigation, and adhering to any deadlines or requirements specified by the insurance company.