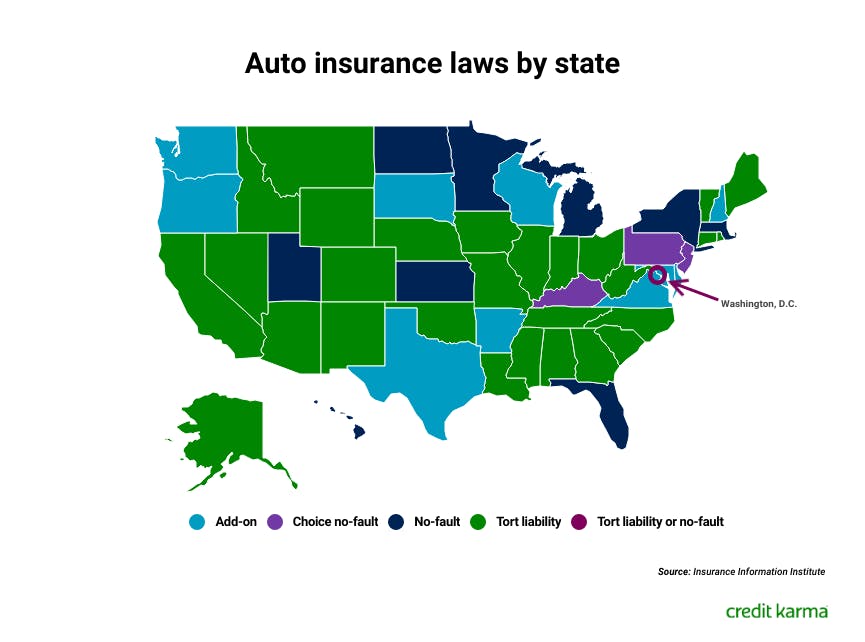

Auto insurance requirements vary by state in the United States, with each state setting its own minimum coverage requirements to legally operate a vehicle on public roads. These requirements typically encompass liability insurance, which covers damages and injuries you may cause to others in an accident. Additionally, some states may mandate other types of coverage such as personal injury protection (PIP) or uninsured/underinsured motorist coverage to provide further protection for drivers. Here’s a brief overview of auto insurance requirements by state:

- Alabama: Liability insurance is required, with minimum limits of 25/50/25 ($25,000 bodily injury per person, $50,000 bodily injury per accident, $25,000 property damage per accident).

- Alaska: Liability insurance with minimum limits of 50/100/25 is required.

- Arizona: Drivers must carry liability insurance with minimum limits of 25/50/15.

- Arkansas: Liability coverage with minimum limits of 25/50/25 is mandatory.

- California: Liability insurance with minimum limits of 15/30/5 is required.

- Colorado: Liability coverage with minimum limits of 25/50/15 is mandatory.

- Connecticut: Drivers must have liability insurance with minimum limits of 25/50/25.

- Delaware: Liability insurance is required, with minimum limits of 25/50/10.

- Florida: Florida is a no-fault state, meaning drivers are required to carry personal injury protection (PIP) coverage and property damage liability (PDL) coverage.

- Georgia: Liability insurance with minimum limits of 25/50/25 is mandatory.

- Hawaii: Liability coverage with minimum limits of 20/40/10 is required.

- Idaho: Liability insurance with minimum limits of 25/50/15 is mandatory.

- Illinois: Liability coverage with minimum limits of 25/50/20 is required.

- Indiana: Drivers must carry liability insurance with minimum limits of 25/50/25.

- Iowa: Liability insurance with minimum limits of 20/40/15 is mandatory.

- Kansas: Liability coverage with minimum limits of 25/50/25 is required.

- Kentucky: Liability insurance is mandatory, with minimum limits of 25/50/25.

- Louisiana: Liability coverage with minimum limits of 15/30/25 is required.

- Maine: Liability insurance with minimum limits of 50/100/25 is mandatory.

- Maryland: Drivers must carry liability coverage with minimum limits of 30/60/15.

- Massachusetts: Liability insurance is required, with minimum limits of 20/40/5.

- Michigan: Michigan is a no-fault state, requiring drivers to carry personal injury protection (PIP) coverage.

- Minnesota: Liability insurance with minimum limits of 30/60/10 is mandatory.

- Mississippi: Liability coverage with minimum limits of 25/50/25 is required.

- Missouri: Drivers must have liability insurance with minimum limits of 25/50/25.

- Montana: Liability insurance with minimum limits of 25/50/20 is mandatory.

- Nebraska: Liability coverage with minimum limits of 25/50/25 is required.

- Nevada: Drivers must carry liability insurance with minimum limits of 25/50/20.

- New Hampshire: While not mandatory, drivers are required to provide proof of financial responsibility if involved in an accident or convicted of certain offenses.

- New Jersey: Liability insurance with minimum limits of 15/30/5 is mandatory.

- New Mexico: Liability coverage with minimum limits of 25/50/10 is required.

- New York: Drivers must carry liability insurance with minimum limits of 25/50/10.

- North Carolina: Liability coverage with minimum limits of 30/60/25 is mandatory.

- North Dakota: Liability insurance is required, with minimum limits of 25/50/25.

- Ohio: Drivers must carry liability coverage with minimum limits of 25/50/25.

- Oklahoma: Liability insurance with minimum limits of 25/50/25 is mandatory.

- Oregon: Liability coverage with minimum limits of 25/50/20 is required.

- Pennsylvania: While not mandatory, drivers must carry either liability insurance or proof of financial responsibility.

- Rhode Island: Liability insurance with minimum limits of 25/50/25 is mandatory.

- South Carolina: Drivers must have liability coverage with minimum limits of 25/50/25.

- South Dakota: Liability insurance with minimum limits of 25/50/25 is required.

- Tennessee: Liability coverage with minimum limits of 25/50/15 is mandatory.

- Texas: Liability insurance is required, with minimum limits of 30/60/25.

- Utah: Drivers must carry liability insurance with minimum limits of 25/65/15.

- Vermont: Liability coverage with minimum limits of 25/50/10 is mandatory.

- Virginia: Liability insurance is required, with minimum limits of 25/50/20.

- Washington: Drivers must carry liability insurance with minimum limits of 25/50/10.

- West Virginia: Liability coverage with minimum limits of 25/50/25 is mandatory.

- Wisconsin: Liability insurance is required, with minimum limits of 25/50/10.

- Wyoming: Drivers must carry liability coverage with minimum limits of 25/50/20.

It’s important to note that while these are the minimum requirements set by each state, additional coverage beyond the minimum is often recommended to provide greater protection in case of accidents or other unforeseen events. Additionally, insurance requirements can change over time, so it’s essential to stay informed about any updates or changes to your state’s auto insurance regulations.