Introduction: Insurance is a crucial aspect of financial planning, providing protection and peace of mind against unforeseen circumstances. However, the plethora of insurance options available can be overwhelming, leaving many individuals unsure of how to select the right policy for their needs. Whether it’s life, health, auto, or home insurance, understanding the key factors to consider can help you make informed decisions and secure the coverage that best fits your requirements.

Assess Your Needs: The first step in choosing the right insurance policy is to assess your needs accurately. Consider your current situation, financial obligations, and future goals. For instance, if you have dependents, a life insurance policy can provide financial support to your loved ones in case of your untimely demise. Similarly, if you own a vehicle, auto insurance is essential to protect against accidents and liabilities.

Research Different Types of Insurance: Once you’ve identified your needs, research the various types of insurance available in the market. Each type of insurance serves a different purpose and comes with its own set of coverage options. Understanding the basics of life, health, property, and casualty insurance can help you narrow down your choices and focus on policies that align with your requirements.

Compare Quotes and Coverage Options: Once you have a clear idea of the type of insurance you need, it’s time to shop around and compare quotes from different insurance providers. Don’t just focus on the premium cost; instead, examine the coverage options, deductibles, limits, and exclusions associated with each policy. Look for a balance between affordability and comprehensive coverage to ensure you’re getting the best value for your money.

Consider the Reputation of the Insurance Company: When selecting an insurance policy, it’s essential to choose a reputable and financially stable insurance company. Research the insurer’s financial strength ratings and customer reviews to gauge their reliability and trustworthiness. A well-established insurer with a strong track record is more likely to fulfill their obligations and provide timely claims settlement.

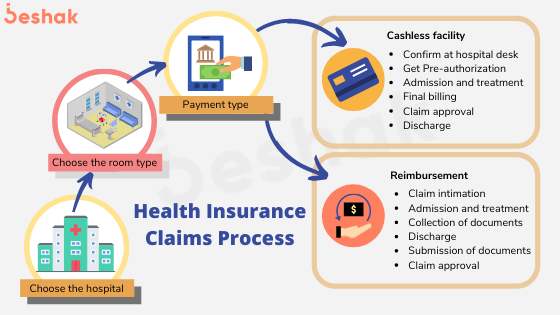

Evaluate Customer Service and Claims Process: Customer service is another critical factor to consider when choosing an insurance policy. Evaluate the insurer’s responsiveness, accessibility, and willingness to address your queries and concerns. Additionally, review the claims process to understand how efficiently and fairly the insurer handles claims. A responsive and transparent claims process can make a significant difference during stressful situations.

Assess Additional Benefits and Riders: Many insurance policies offer additional benefits and riders that can enhance your coverage and tailor it to your specific needs. For example, life insurance policies may include riders for critical illness coverage or disability benefits. Similarly, health insurance plans may offer add-ons for maternity coverage or dental care. Assess these additional benefits carefully to determine if they align with your needs and justify any extra costs.

Review Policy Terms and Conditions: Before finalizing your insurance policy, thoroughly review the terms and conditions outlined in the policy documents. Pay attention to the coverage limits, exclusions, waiting periods, and renewal terms to avoid any surprises in the future. If you have any doubts or questions, don’t hesitate to seek clarification from the insurer or a licensed insurance agent.

Seek Professional Advice if Needed: If you’re unsure about which insurance policy to choose or find the process overwhelming, don’t hesitate to seek professional advice from an insurance agent or financial advisor. An experienced professional can assess your needs, provide personalized recommendations, and help you navigate through the complexities of insurance products.

Conclusion: Choosing the right insurance policy requires careful consideration and research. By assessing your needs, comparing options, evaluating insurers, and reviewing policy terms, you can make informed decisions and secure the coverage that offers the protection you need. Remember, insurance is not just about safeguarding your assets; it’s about securing your financial future and providing peace of mind for you and your loved ones.